EU commercial

From the federal city of Bonn to the EU

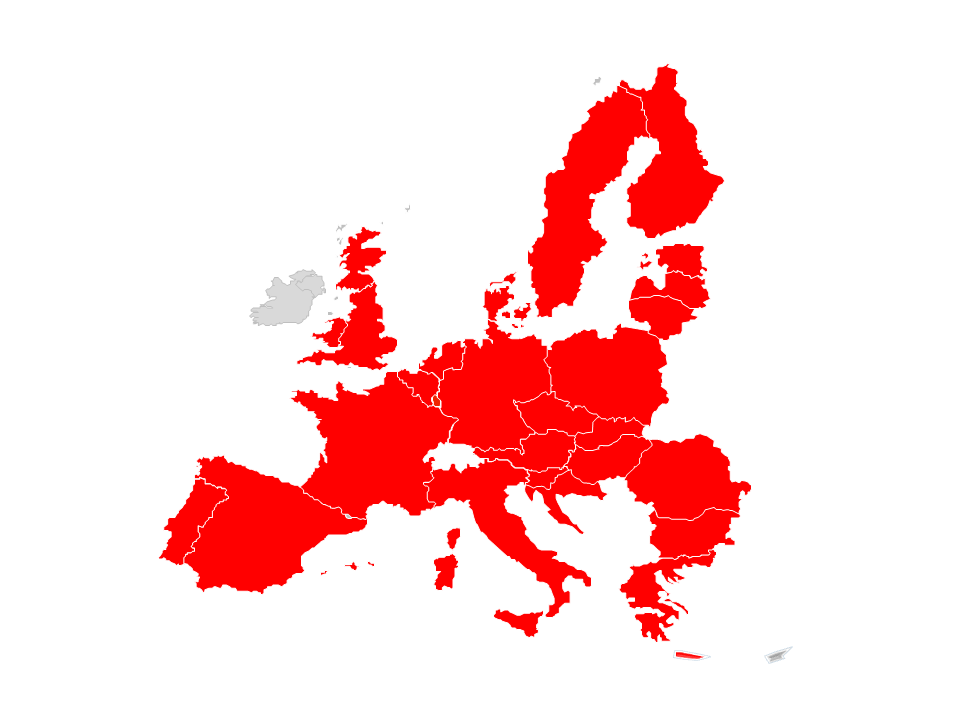

We have already exported our vehicles from our home market of Germany to almost all member states of the European Union:

Belgium, Bulgaria, Denmark, Estonia, Finland, France, Greece (mainland and Crete), Great Britain, Italy, Croatia, Latvia, Lithuania, Luxembourg, the Netherlands, Austria, Poland, Portugal, Sweden, Spain, the Czech Republic and Hungary.

We have also already sold vehicles to the Canary Islands, which are an outermost region (OMR). are members of the EU but not of the EU VAT Union and are therefore subject to special export regulations. You are welcome to contact us about this too.

Only Ireland and Cyprus are not yet colored on our EU map (and to be precise, Northern Ireland, which is a member of the EU together with Great Britain as the United Kingdom).

We are therefore very familiar with EU goods deliveries - and you can count on our expertise.

Special features for commercial customers

There are a few special features for commercial customers in the EU to note:

If you buy a vehicle for which sales tax is deductible and you are a company based in the EU, we will refund you the full amount of sales tax as soon as the vehicle has verifiably arrived at its destination. is.

Some documents are required for this:

• Commercial register extract or corresponding official document with proof of the authorized signatories (company owner/managing director)

• ID or ID copy of the authorized signatory company owner/managing director

• VAT identification number

• Address

• Proof of purchase

• Original passport/ID of the person collecting the goods

• Power of attorney for the authorized person collecting the goods

• Certificate of arrival

We will provide you with the relevant forms in good time, so that you only need to fill them out and sign them and send them back to us.